New secured transactions law issued, implementation set for next year

TDT | Manama

Email: mail@newsofbahrain.com

A new law governing secured transactions has been issued in Bahrain, with its implementation scheduled to begin next year following a phased rollout.

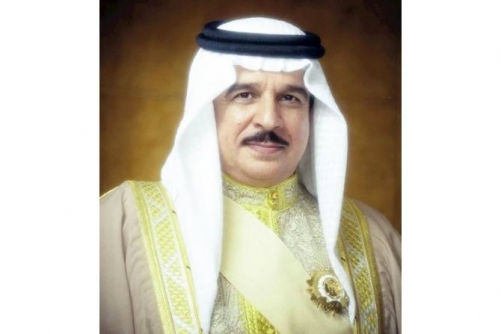

Law (3) of 2026, establishing the Secured Transactions Law, was ratified and promulgated by His Majesty King Hamad bin Isa Al Khalifa yesterday, after receiving approval from the Shura Council and the Council of Representatives. Under the law, its provisions will come into force from the first day of the month following twelve months from the date of its publication in the Official Gazette. Before that, the minister concerned with commerce, or another minister assigned by decree, is required to issue the executive regulations needed to implement the law, after Cabinet approval, within eight months from the day following publication.

For matters related to the right of security that are not specifically addressed in the new law, existing legislation will continue to apply, provided there is no conflict. These include the Commercial Companies Law, the Civil Code, and the Central Bank of Bahrain and Financial Institutions Law.

As outlined during the Shura Council’s approval of the bill last year, the Secured Transactions Law is intended to create a unified legal framework allowing businesses to use movable assets such as receivables, inventory, stock, and other non-real-estate assets as collateral for financing.

The legislation was presented to legislators as a way to widen access to credit, particularly for small and medium-sized enterprises, by giving lenders clearer security rights and allowing companies to keep using pledged assets in their operations. Central to the system is an electronic notice register designed to record security rights, clarify priorities between creditors, and support enforcement.

During earlier debates, legislators also noted that much of the law’s practical impact would depend on the executive regulations, including rules governing transparency, creditor priorities, and enforcement procedures, with calls for sufficient transition time to allow banks and businesses to adjust.

The Prime Minister and the ministers, each within their respective capacities, will implement the provisions of the law once it enters into force.

Related Posts