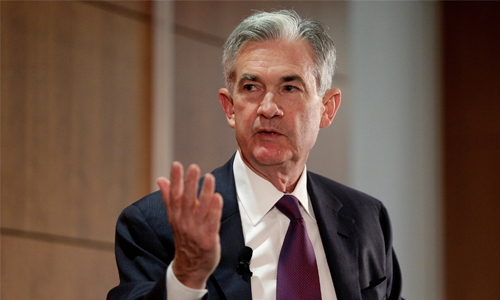

US business debt a ‘moderate’ economic risk: US Fed’s Powell

The American private sector’s mounting debts pose a “moderate” risk to the world’s largest economy, Federal Reserve Chairman Jerome Powell said Monday. With corporate debts reaching historic highs relative to the size of the economy, public comment has run the gamut, according to Powell, either warning of grave danger or waiving off such threats as “nothing to worry about.” But the truth, he said, according to a copy of remarks prepared for a speech in Florida, was “likely somewhere in the middle.”

“As of now, business debt does not present the kind of elevated risks to the stability of the financial system that would lead to broad harm to households and businesses should conditions deteriorate,” Powell said. “At the same time, the level of debt certainly could stress borrowers if the economy weakens.” Economists warn that after years of economic recovery and low interest rates, companies across the spectrum of US industries now frequently have debts that are several times greater than their earnings, with debt growing faster than the economy for the last decade.

Should interest rates rise or the economy slow, this could leave them struggling to repay, creating a risk to the wider economy. Nevertheless, Powell said it was incorrect to draw parallels with the collapse in mortgage-backed securities which led to the global financial crisis in 2008. Banking reforms after the crisis have made the financial sector resilient enough to handle such losses, there are few signs of an asset price bubble and the investment vehicles used to trade in debt are more sound, according to Powell. Nevertheless there is clear cause for concern, he said.

“Corporate debt relative to the book value of assets is at the upper end of its range over the past few decades,” said Powell, adding that investment-grade corporate debts were verging on junk. The Fed earlier this month issued a similar warning, saying in its latest report on financial stability that a large appetite for risk had kept stock prices relative to expected earnings above their average of the last 30 years. The International Monetary Fund also warned recently that rising debt levels posed a threat to the global economy

Related Posts