Bahrain stands first in FDI per capita in GCC

TDT | Manama

The Daily Tribune – www.newsofbahrain.com

Staff Reporter

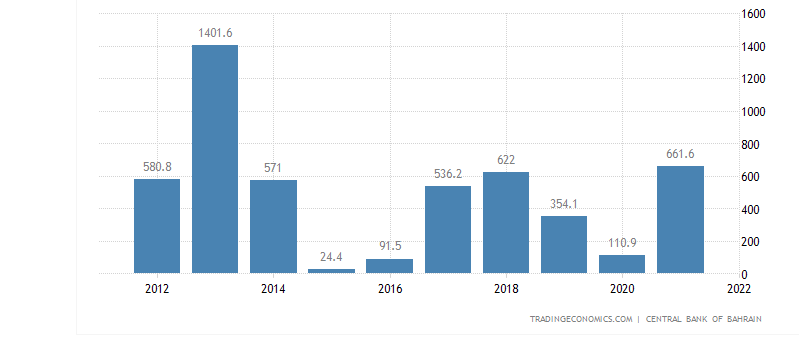

Serving testimony to Bahrain’s efforts to diversify the economy and attract foreign investments, a study by a leading management consultancy firm has revealed that Bahrain has the highest Foreign Direct Investment per capita in the GCC along with an FDI inward stock of 92 per cent.

The country’s national strategy is pivoting to become more sustainable and competitive by investing in future-defining oilproof sectors, as the COVID-19 pandemic underscored the need for economic growth through the accelerated uptake of innovation and digital economy, the management consultancy observed.

“As a result,Bahrain has amplified plans for economic diversification through Foreign Direct Investment (FDI), backed by several competitive advantages that make FDI attractive.” This was revealed by Arthur D. Little (ADL) in its latest report entitled Situating the Kingdom of Bahrain in a Future World: Opportunities for Foreign Investment.

The report analyses the opportunities and challenges awaiting Bahrain in light of neighbouring economic activity and an increasingly tech-oriented global economy, providing insight on how Bahrain can ultimately become a economic powerhouse. “Despite being a smaller market in regional terms, the Kingdom of Bahrain’s highly favorable investment environment is clear for all to see,” explained Andreas Buelow, Partner, Arthur D Little Middle East.

“The country has the infrastructure and potential to attract robust FDI across various emerging sectors in the short, medium, and long-term, with projects holding high-success rates in areas such as renewable energy, health management, financial services, cloud computing, and technology incubation.

“Challenges always accompany opportunities, and disruption of varying degrees will continue casting uncertainty as national ambitions are pursued in the years ahead. However, the Kingdom of Bahrain is favorably positioned to not only capitalise on FDI openings, but also create the same vibrant future that the Kingdom’s leadership and wider business community both envisage.” Already, Bahrain has embarked on an economic diversification campaign to establish the GCC’s first ‘post-oil’ economy.

The country recently unveiled a plan to balance the public budget by 2024. It aims to implement investment projects worth USD 30 billion and is targeting a 5 per cent growth in the non-oil economy for 2022, prioritising six key sectors: oil and gas; tourism; logistics; financial services; telecom, IT, and digital economy; and manufacturing.

“The Kingdom boasts the highest FDI per capita in the region, as well as an FDI inward stock of 92 per cent in terms of nominal gross domestic product (GDP) – the highest in the GCC. Therefore, the foundations are in place for heightened FDI attractiveness that dramatically boosts the current GDP of USD 30 billion.”

The report sheds light on the specific competitive advantages through which the Kingdom of Bahrain can realise this objective, including high government responsiveness, low cost of doing business, and full foreign ownership. Moreover, the country houses a skilled local workforce and a series of global trade agreements, such as free trade agreements (FTAs) with 22 countries, foreign investment protection and promotion agreements (FIPAs) with 34 countries, and double taxation avoidance agreements (DTAAs) with over 40 international partners.

Given this level of strategic positioning, there are numerous possibilities for the Kingdom to consider and pursue in due course, the report highlighted. “For instance, the regional renewables investment outlook is particularly optimistic, and the Kingdom could consider joint renewable energy projects with Saudi Arabia (KSA) by installing solar energy panels across the King Fahad Causeway that links the kingdom over water with Saudi Arabia.

“Another possibility concerns manufacturing by building on a national pillar of strategic importance such as the expansion of existing and well-developed industrial sectors, notably aluminum. The Kingdom remains one of the world’s major aluminum smelters and the largest in the GCC.” The report said the country could increase its current advantage by exploring sub-sectors where aluminum end-use is attractive, including automobile parts, packaging, and renewable energy components.

“Furthermore, the Kingdom could act as a technology incubator and testing center for nationwide 5G applications, developing 5G infrastructure and services across different sectors. “As for Financial Services also, it remains one of the strongholds of the Kingdom, whereby the country has recently managed to attract a global technology hub for Citibank for over 1,000 coders, demonstrating the attractiveness of the country in this area.”

Having examined Bahrain’s entire FDI landscape, Arthur D Little’s newest report identifies specific challenges in anticipation and provides insights about the most prudent courses of action for overcoming obstacles and making full use of upcoming opportunities.

The country’s small domestic market and challenging fiscal position could be overcome by carving a niche in the global landscape for specialised economic activities, whilst continuing to act as a trusted regional economic partner and leverage in full the global potential of its local workforce.

“As the Kingdom of Bahrain prepares to move forward, driving innovation, establishing new partnerships with neighbouring countries, and utilising existing resources are viable, effective avenues for overcoming the most difficult challenges at hand,” added Buelow. “Technology will certainly be a key enabler of any positive eventualities and central to all future economic activities. Consistent implementation over the long haul will be key to success.”

Related Posts