Economic growth thrives in first 10 months: CBB

TDT | Manama

The Daily Tribune – www.newsofbahrain.com

The economic activities in the Kingdom demonstrated positive trends throughout the initial ten months of the current year compared to the corresponding period in the previous year, as reported by the Central Bank of Bahrain.

This came as Board of Directors of the CBB conducted a review of the performance report and financial sector developments for the fourth quarter of 2023 during a meeting chaired by Hassan Khalifa Al Jalahma.

The meeting assessed advancements in the Financial Services Sector Development Strategy, along with the scrutiny of the estimated budget and investment policy of the CBB for the year 2024.

Money supply rises 3.7%

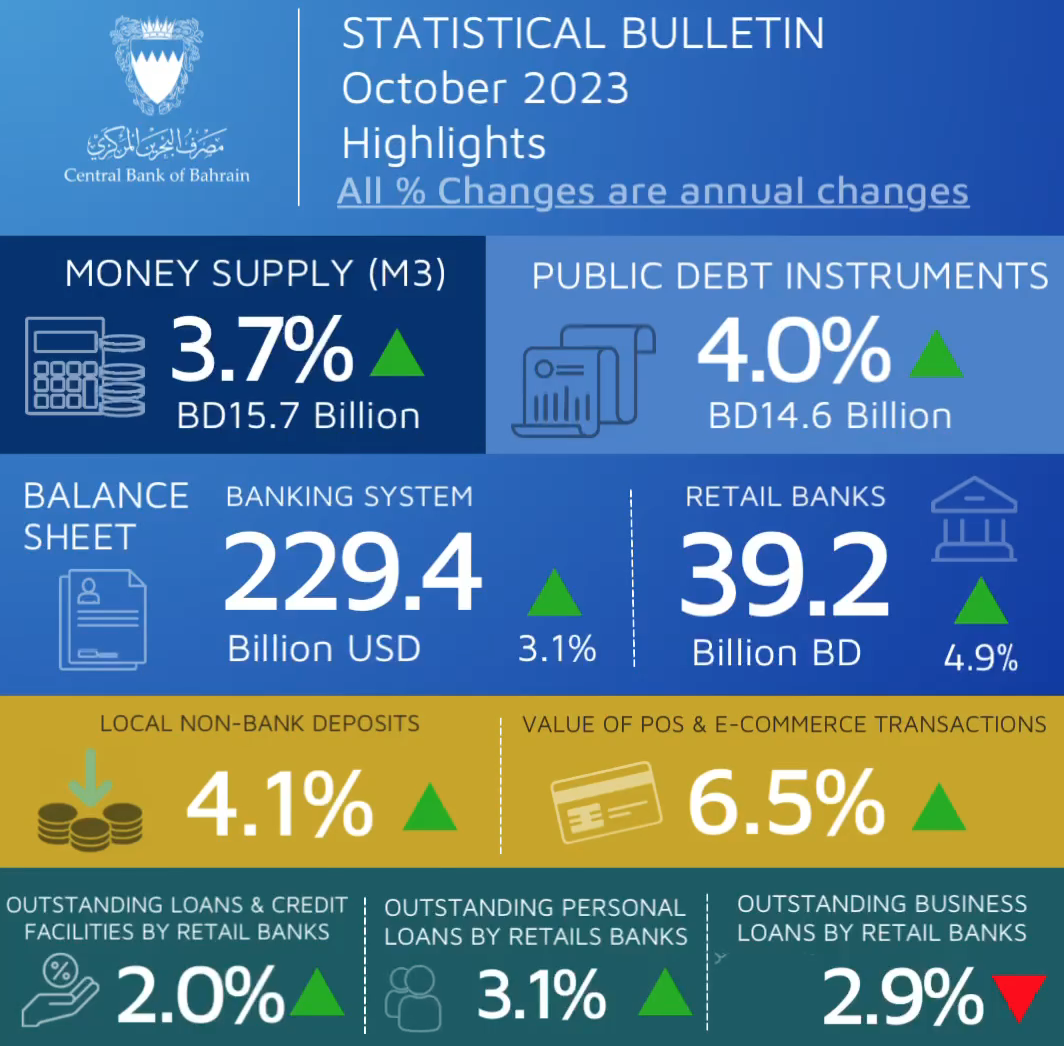

Examining key indicators, the board noted a 3.7% increase in the money supply in Bahrain, reaching BD 15.7 billion in October 2023 compared to the end of October 2022.

Additionally, private deposits in retail banks rose to BD 13.9 billion by the end of October 2023, marking a 4.1% increase from the end of October 2022. The outstanding balance of total loans and credit facilities extended to resident economic sectors reached BD 11.6 bn at the end of October 2023, reflecting a 2.0% increase from the end of October 2022.

The Business Sector accounted for 43.6%, and the Personal Sector constituted 50.3% of the total loans and credit facilities. The combined balance sheet of the banking system, comprising retail banks and wholesale sector banks, expanded to $229.4 bn at the end of October 2023, indicating a 3.1% increase from the end of October 2022.

POS transactions surge

Point of Sales (POS) data revealed a surge in transactions during the first ten months of 2023, totalling 151.0 million transactions, with 77.5% being contactless—a 13.1% increase compared to the same period in 2022.

The total value of POS transactions amounted to BD 3.4 bn, with 50.5% being contactless—a 7.0% increase from the same period in 2022.

Capital adequacy ratio at 19.4%

The banking sector maintained robust capital adequacy and liquidity, with the capital adequacy ratio reaching 19.4% at the end of Q3 2023. Specific ratios for different banking sectors were reported as follows: 21.7% for conventional retail banks, 17.2% for conventional wholesale banks, 20.5% for Islamic retail banks, and 17.9% for Islamic wholesale banks.

As of the end of October 2023, the total number of Collective Investment Undertakings (CIUs) stood at 1,672, with the total net asset value (NAV) decreasing from US$ 11.5 bn at the end of Q3 2022 to US$ 10.9 bn at the end of Q3 2023—a 5.2% decrease.

However, the NAV of overseas domiciled CIUs increased from US$ 6.0 bn at the end of Q3 2022 to US$ 6.6 bn at the end of Q3 2023, reflecting a 10.0% increase. Furthermore, the NAV of Shari’a-compliant CIUs increased from US$ 1.2 bn at the end of Q3 2022 to US$ 1.7 bn at the end of Q3 2023, indicating a substantial increase of 41.7%.

Related Posts