Cashless payments on the rise in Bahrain

Head out of the office for a lunch, and you might end up at one of those starred restaurants to enjoy the amazingly flavourful plates or Michelin quality pieces of art. In the evening, for a coffee, you might pick one of those traditional coffee houses, serving up traditional Arabic Coffee.

In either case, you’d end up doing the latest fad, Pay with plastic! You heard it right. Off late, people in Bahrain are more interested in paying with plastic- their cards- rather than carrying stacks of cash in their wallets. The trend is more evident at restaurants where customers are increasingly slapping down plastic instead of dinars.

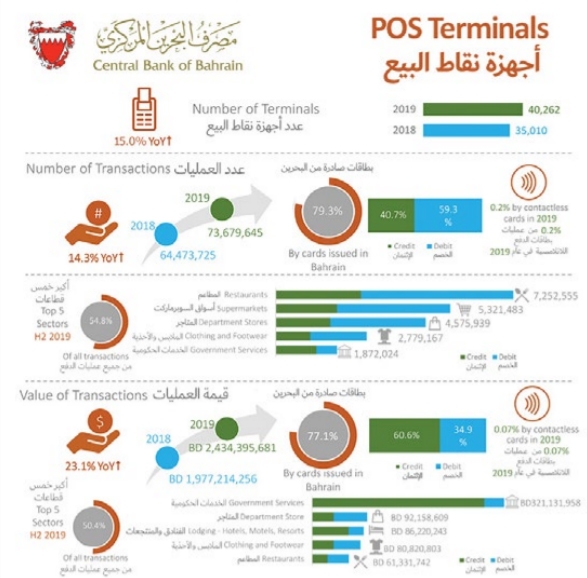

Data published by the Central Bank of Bahrain is confirming this trend. CBB data showed a steady growth in the number and value of POS operations during 2019. The restaurant sector recorded the highest number of transactions compared to the remaining sectors as it recorded 7,252,555 transactions.

Supermarket market sector followed with 5,321,483 transactions, department stores with 4,575,939 transactions, and clothing and footwear 2,779,167 transactions and government services 1,872,024 transactions, respectively. In short, the number of POS transactions through credit and debit cards increased from 64,473,725 transactions in 2018 to 73,679,645 transactions in 2019, i.e. 9,205,920 transactions or 14.3 per cent.

It is worth noting that the percentage of transactions from cards issued in Bahrain constituted 79.3pc of the total number of those transactions. Credit, debit cards The data showed that the value of POS transactions through credit and debit cards increased from BD 1,977,214,256 in 2018 to BD2,434,395,681 in 2019, i.e. at a value of BD 457,181,425, or 23.1pc, of which the transactions of cards issued in Bahrain accounted for 77.1pc of them.

Government sector tops Within the top five sectors, which constituted 50.4pc in terms of transaction amounts, the government services sector recorded the highest sector in terms of transaction value at BD321,131,958 during 2019, followed by the department stores at BD92,158,609, hotels, motels and resorts at BD86,220,243, clothing and footwear at BD80,820,803 and restaurants at BD61,331,742.

The number of POS terminals increased from 35,010 at the end of 2018 to 40,262 at the end of 2019, an increase of 15.0pc. Fawri, Fawri+ and Fawateer As for the Electronic Funds Transfer System (EFTS) which includes Fawri, Fawri+ and Fawateer, an increase has been recorded compared to the previous year. The total amounts transferred through Fawri increased from BD11.2 billion in 2018 to BD12.7 billion in 2019, an increase of 13.4pc.

The total amounts transferred through Fawri+ increased from BD174.7 million in 2018 to BD542.9 million in 2019, an increase of 210.8pc. The total amounts transferred through Fawateer also increased from BD133.1m in 2018 to BD291.4m in 2019, an increase of 118.9pc.

The number of digital wallet transactions has increased by 566.7pc from 1.2m in 2018 to 8.0m in 2019. The amounts transferred through digital wallets have increased from BD 28.9m to BD 409.4m, i.e. an increase of 1,316.6pc during the same period.

Related Posts