Bahrain, a hub for Islamic finance industry

Bahrain is a major hub for the Islamic finance industry in the GCC and globally, according to Islamic Finance ESG (Environmental, Social and Governance) Outlook 2019. One of the factors driving Bahrain’s growth in this direction, the report said, is the launch of the Global Islamic & Sustainable FinTech Centre by Bahrain FinTech Bay to encourage growth in Islamic FinTech through alignment with sustainability.

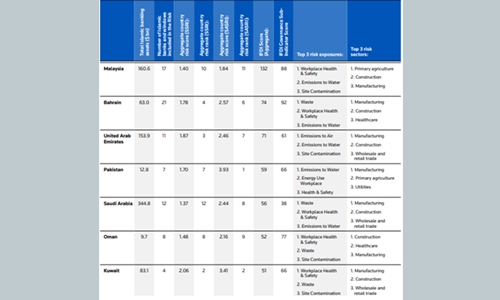

The report also mentions the Sustainable Stock Exchange Initiative joined by Bahrain Bourse. Bahrain’s Islamic banks, the report said, face lower risks from ecosystems management, disaster risk mitigation, and water use. Commenting, Khalid Humaidan, Chief Executive at the Bahrain EDB said: “It’s a pleasure to once again see Bahrain leading the region in Islamic Finance development.”

“Our continued high ranking in the IFDI is a testament to our innovative and pioneering approach,” Humaidan said. Kingdom, the chief executive said, has managed to position itself not only as of the region’s FinTech hub but also as a testbed for regulating emerging and cutting-edge technologies such as blockchain and open banking.

Crypto-assets

The report highlighted FinTech as a key driver and shaper of the Islamic finance industry, noting that crypto-assets are also being explored by sharia scholars and regulators in developed Islamic finance markets such as Bahrain and Malaysia. Rain – the region’s first sharia-compliant cryptocurrency exchange – was the first graduate from the Central Bank of Bahrain’s FinTech Regulatory Sandbox, earlier this year, and has recently obtained a full operational license.

Ayman Sejiny, CEO of ICD, said: “Despite the stressed global economic environment and sluggish growth which are impacting the industry, we have found that the dynamics in the industry are changing. Sukuk are leading the industry’s growth, with global issuance since its introduction surpassing US$ 1 trillion in 2018 and continuing to grow.

The industry and the surrounding ecosystem are also being constantly reshaped by innovation. This is particularly in the areas of financial technology and sustainability which aligns with the strategies of ICD.”

Related Posts