Bahrain rentals subdued

Manama : Residential and office rents are expected to decline or stay lacklustre in 2016, according to the latest property market outlook by Cluttons. Retail rents are expected to buck the trend and remain resilient.

“It is our view that average rent (residential) declines of up to five per cent is likely this year, with some areas expected to remain stable,” the outlook predicts.

Explaining the likely causes of the decline, Clutton says, “In general, average budgets range between BD500 and 600 per month, with Western expat families’ budgets for villas hovering around the BD900 per month mark. However, the gradual removal of energy subsides, coupled with a weak economic outlook, mean that both overall tenant requirement levels and budgets are likely to fall during 2016.”

“While rents have remained stable thus far in 2016, once the regular season of tenancy renewals commences in April, it is likely that there will be an increased amount of rent negotiations at renewal as tenants move to rein in costs. In particular, the removal of utility subsidies remains a complex issue, with little clarity on whether the increased cost should be borne by tenants or landlords.”

Also, according to the report, the US Navy, which remains a key source of tenants in submarkets such as Juffair, continues its cost-cutting drive, by opting for exclusive lease agreements, which exclude utilities and municipality fees. This is expected to translate into lower budgets going forward from this important tenant group.

Similarly, rents across Manama’s main office markets have remained static, with the Financial Harbour and World Trade Centre retaining the top spots as the most expensive buildings for occupiers during Q1.

Over the last 12 months, however, rents for fitted out office space in Al Seef have risen. The vast majority of occupier activity in the area is, however, being driven by a small amount of relocation activity within Manama, rather than by new entrants, the report says.

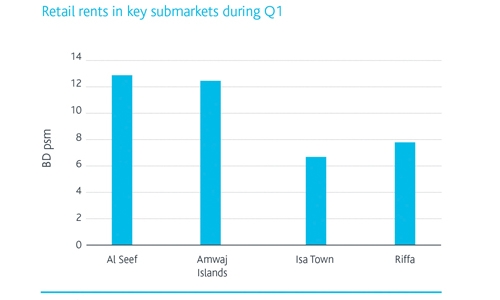

Clutton’s report says that the retail sector remains the standout performer with rents stable in all the main markets of Manama during the first quarter of 2016.

Harry Goodson-Wickes, Head of Cluttons Bahrain, said, “We continue to see demand for retail across Bahrain with budgets remaining stable around the BD12 per square metre mark. However, if supply continues to edge ahead of demand, headline rents may fall. Rents will also be impacted by the general economic slowdown that the Kingdom is facing and it will likely cause increased downward pressure as demand stabilises this year.”

“The Kingdom’s retail sector is still perceived as being a key retail and hospitality hub for Saudi Arabia, with the weekend tourist traffic being a particularly big draw for domestic and international retailers. In addition, the government is focusing on its strategy to attract high-end tourists, which is driving an upturn in the number of five-star hotels. However, we believe the family market remains vastly underserved, but there are signs to suggest that developers are now seeking to target this segment.”

Related Posts