Bahrain remittance cost may increase by 100 pc

The proposal to impose remittance tax has stirred a huge outcry from the expat community in Bahrain.

Expats pay BD 1 plus buy/sell spread on every remittance to their home country.

As per the proposal, taxes of one per cent on the remitted amounts, will double this transaction cost.

The cost of remittance for the labour class will be much higher, as they tend to remit less than BD100 at one time.

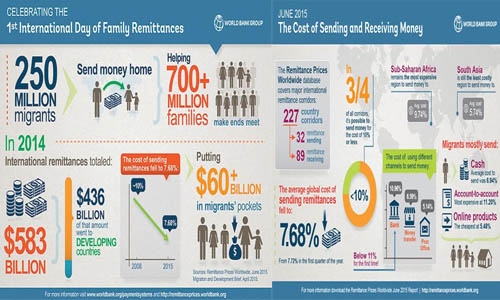

The World Bank estimates that 7.68 pc is the global average cost for sending US$200.

The Central Bank of Bahrain (CBB) had pointed out recently that imposing charges on remittance would have a bad impact on the foreign employment in the kingdom and might create new illegal channels to transfer funds abroad.

It also contradicts with the development of non-oil income sources that are followed by the government.

Expats are attracted to Bahrain owing to its stated policies which aims to be the region’s most liberal business environment, with zero taxation for private companies, few indirect taxes for private enterprises and individuals, and free repatriation of capital.

The proposal, they say, is not in line with the stated policies.

The main argument raised by MPs for proposing the tax is that expats are depositing their income in their home countries as savings instead of spending it here.

It has been pointed out that financial services industry, employing hundreds of locals, is depended on this remittance for their revenue.

Besides, the expat population spend, according to various estimates, 80 pc of their income in the kingdom.

The people who are not spending here and sending bulk of the amount back home is the labour class, who, because of their low income, are forced to deny themselves many basic necessities.

Also, expats point out that the interest on the bank deposit they make in their home country might get them only 4pc to 8 pc, depending on the country, and if an extra one pc is shaved off due to the proposed tax, it will reduce their disposable income.

If an expat’s home country banks are paying 4 pc annual interest, the new tax will dent the return by 25 pc.

This will be a huge blow to many expat households, mostly old -aged parents depended on the same.

The proposal, it has been pointed out, runs contrary to global efforts in cutting down costs related to expatriate remittance.

G20 nations had orchestrated a campaign in earlier years, which reduced the cost of remittance global average to 7.6 pc from 10 pc in 2009; the target set is 5 pc.

World Bank estimates that this saved migrants and their families more than US$60 billion.

Related Posts