GCC Surges Ahead Despite Global Slump

TDT| Manama

Email : editor@newsofbahrain.com

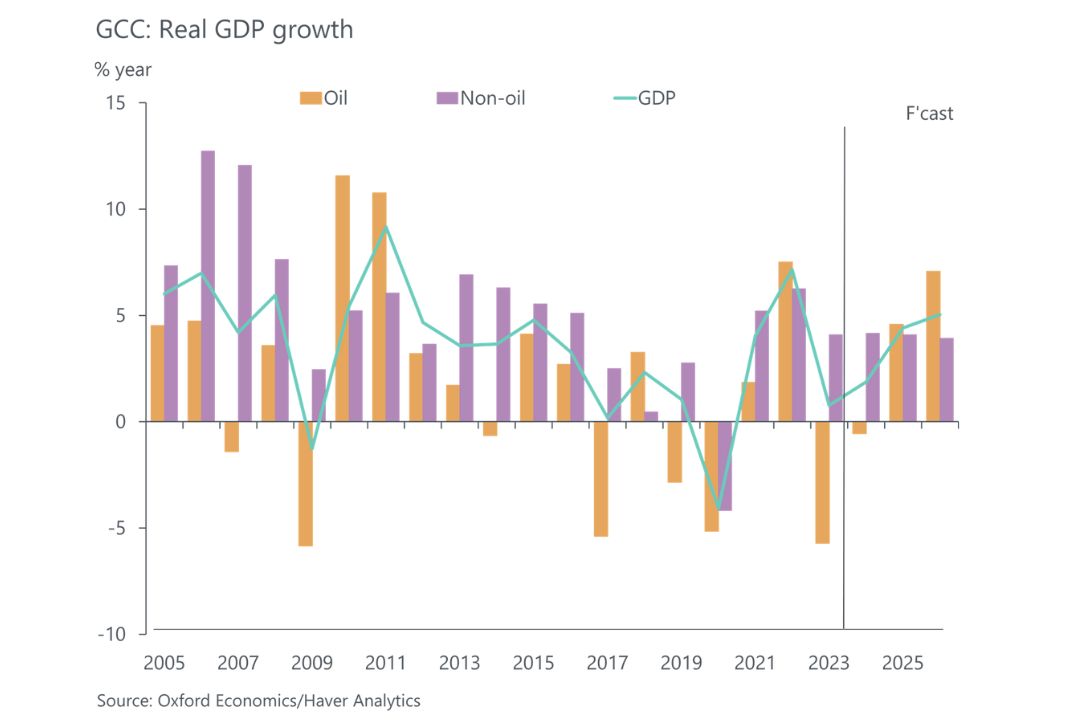

The Gulf economies are expected to grow faster than earlier projected, defying a broader global downturn and weak oil prices, according to the latest ICAEW Economic Insight report released on Monday. The Q2 update revises the GCC’s 2025 GDP forecast upward to 4.4% from 4.0%, underscoring the region’s resilience amid rising trade barriers and fiscal pressures.

Prepared by Oxford Economics for ICAEW, the report contrasts the GCC’s improved outlook with the downgrade in global GDP growth to 2.4%, the slowest pace since the 2020 pandemic shock.

Oil and beyond

A key driver behind the upgraded outlook is a faster-than-expected reversal of OPEC+ production cuts, which has lifted oil sector growth projections from 3.2% to 4.5%. However, the Brent crude average for 2025 is still forecast at a modest $67.3 per barrel, limiting fiscal space for several states.

Only the UAE and Qatar are projected to maintain surpluses in 2025. Most other member states are likely to face tightening budgets, with Saudi Arabia forecast to run a deficit of 3.4% of GDP as spending outpaces oil revenues.

Still, non-oil sectors are holding up strongly across the region, with forecast growth of 4.1% in 2025 driven by domestic demand, investment momentum, and diversification initiatives. The report highlights that the region remains well-positioned to absorb trade rebalances resulting from the 10% US tariff on GCC imports, which excludes energy products and has limited impact due to low US export exposure.

Leaders of the pack

Saudi Arabia’s GDP forecast has been revised up to 5.2% for 2025, driven by strong oil output and a 5.3% projected rise in non-oil activities. Despite an 18% year-on-year drop in oil revenues during Q1 and growing fiscal deficits, investor confidence remains firm, with S&P upgrading the Kingdom’s credit rating to A+.

The UAE is expected to post 5.1% growth in 2025, supported by a 4.7% rise in non-oil GDP, increased oil output, and continued strength in tourism and investment. The D33 agenda and AI-focused collaborations are seen as key contributors to its expanding economic base. Dubai’s 5.3 million international visitors in Q1 highlight the momentum in the tourism sector, projected to contribute nearly 13% of the UAE’s GDP this year.

Future outlook While the global economy struggles under trade tensions and slowdowns, the Gulf appears to be charting its own course, powered by diversification, infrastructure spending, and a strategic recalibration of oil production.

df

Related Posts