Halla Bahrain… VAT Calling

“1st January 2018, VAT Mubarak GCC region” – the Kingdom of Saudi Arabia (KSA) and the United Arab of Emirates (UAE) implemented their domestic VAT laws. These countries fulfilled their commitment of implementing VAT law in their respective countries as per the Common VAT agreement signed by the 6 member states of the Gulf Co-operation Council (GCC) in November’ 2016 (Kingdom of Bahrain, Sultanate of Oman, State of Kuwait and Qatar being 4 other countries).

The Unified VAT agreement is the framework agreement which provides all the necessary guidance on how a member state should frame its domestic VAT law including matters such as in which country a particular transaction will attract VAT (Place of supply rules), when VAT is payable – on billing or supply or receipt (Point of Taxation), how to treat transactions between GCC member states, how to deal with exports and imports, rate of VAT (@ 5%), etc. The said agreement also gives discretion to member states to decide on the operative part of the VAT law (such as due date of payment of VAT, filing of VAT returns, list of exempt / zero rate items, etc.) but within the defined framework. Further, not all GCC member states were required to implement this tax at the same time. KSA and UAE have taken a big step forward to manifest the new tax regime (for a sustainable federal revenue) and are leading the way for the GCC region to implement their domestic VAT laws.

Further, the UAE, KSA and Kingdom of Bahrain (Bahrain) have already explored further streams of tax revenue and implemented the Excise Tax (also popularly called the ‘sin tax’) in conjunction with the Common Excise Tax Agreement signed between the said 6 GCC nations. While KSA and UAE implemented Excise Tax in June’ 17 and October’ 17 respectively, Bahrain implemented Excise on 30 December’ 2017. Ins all the 3 countries, Excise is applicable on the same 3 products and at the same rate - Tobacco (100%), Energy Drinks (100%) and Aerated Drinks (50%).

Bahrain is committed to the GCC region together with the other member states that signed the Unified VAT agreement. Further, historically, Bahrain has been supportive of the laws propagated and / or implemented by KSA and GCC as a whole. Many newspapers articles have quoted Ministry of Finance (MoF) mentioning VAT law to be implemented in 2018. Hence, these are tangible indicators that not only Bahrain is next in line but also decisive with the implementation of VAT and the expectation is either by July’ 2018 or October’ 2018.

Impact of VAT on Business

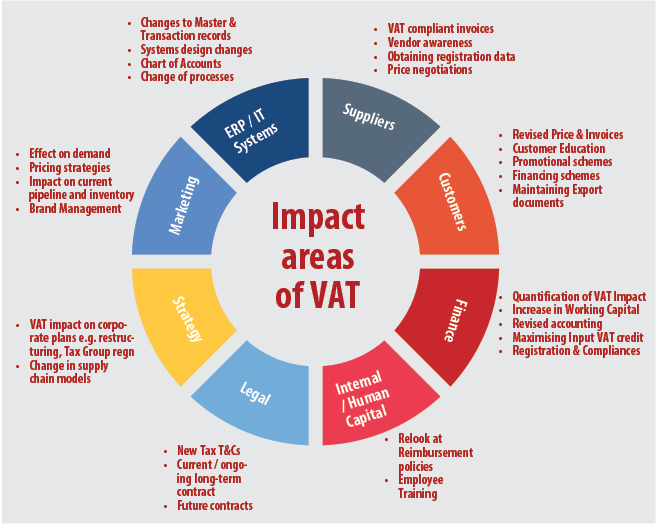

Bahrain has been a strategic place to do business and trade for centuries. Though oil is considered the largest portion of Bahrain’s economy, Bahrain continues to stay relevant in the region by investing in multiple industries, particularly the tourism, hospitality, financial and real estate sector. VAT is not just an additional sum to be collected from the customer, it impacts many facets of Business operations – from contracts (tax clauses), Accounts payable (proper vendor invoice, separate accounting of input tax), cash flow requirement, product pricing & declarations, etc.

Given that VAT will most likely get implemented in Bahrain in 2018, businesses operating in Bahrain need to gear up for this challenge and be VAT ready. Awareness and timeliness are key. Many businesses have already taken the initiative to become VAT ready. For other business houses, it is advised to determine the impact of VAT on their operations and consider a sustainable IT framework to manage, control as well as archive data related to sales, purchase, input ax deductibles (credits), supporting documents, etc for reconciliation with the local tax authorities for VAT.

Learning from KSA and UAE

The implementation of VAT in KSA and UAE has given a fair amount of experience of dealing with VAT in a region where Tax has been an alien concept. The writing on the wall is: “VAT is not complex if understood properly and implemented timely”.

The key learnings for KSA and UAE, which stand out are:

•Businesses who started late were running desperately in the end to catch the bus

•Penalty notice were flowing for late registrations, issuance of wrong invoices, non-furnishing of details

•For exporters & importers, integration of VAT and customs was very critical… There were many delays in consignment clearance by Customs due to VAT registration details not fully updated in government systems.

•ERP vendors were not available to support if not booked early

•VAT consultants fee soared 3-4 times in the last quarter of implementation

•Training and awareness session for staff at operating level is very critical

•Be ready for late announcement of rules (e.g. announcement of rules for Designated Zones in UAE) as well as frequent changes in Tax rules (e.g. change in Place of supply rules), that can be expected in the initial days of VAT implementation

•Senior Management was not comfortable whether on the go-live date they can say “all is well”

All this indicates a timely head start and proper resourcing will help weather the VAT storm and make VAT look simple.

What should businesses do?

The first question that arises is how to start an impact assessment when there is no draft VAT law or rules issued by the MoF, Bahrain.

The answer is simple: VAT laws of each GCC country are to be framed as per the GCC Unified VAT Agreement. The said agreement is a tax code in itself. Further, as a proof of concept VAT laws of KSA and UAE are 70%-75% same and in line with the GCC Unified VAT Agreement. The VAT law of Bahrain is expected to follow the same pattern.

Hence there is an enough material to start an Initial assessment. This can be based on KSA law since historically laws in Bahrain have been similar to the laws in KSA. Tweaks may be done to sector such as Financial services or Real estate whose market dynamics are similar to UAE.

The said initial assessment can be finalised when the MoF, Bahrain issues draft of VAT law and regulations which is expected to be issued 3-5 months before implementation date (going by the experience in KSA & UAE).

The steps business should follow

The answer for this will actually depend on the size of operations, number of group entities, complexity of the corporate structure, risk parameters. Big groups should start early and assemble a ‘VAT Implementation team’ which will be combination of key Internal resources and External experts (VAT, ERP) to execute the project. Further, a “VAT Screening Committee” comprising of heads of Finance, IT, Corporate Planning, Procurement, needs to be constituted to periodically overseas the progress of VAT implementation… Project management will be key. Due regard has to be made to the time that will take to change ERP, systems & processes. The indicative steps to be followed are:

Develop VAT Implementation Project plan & set up the VAT Project team

Initial Impact assessment and readiness review

Plan for ERP, System and Process changes

Final assessment basis Bahrain VAT law & rules

ERP, System and Process changes with Training and Awareness

Review of tax function – Resources, Tax positions and Compliance process

Go Live

Setting up VAT controls as part of the Internal Audit plan

Being VAT Assessment ready

To summarize:

Implementation of VAT in Bahrain is a matter of time. Business should gear up and prepare themselves for the changes this new levy brings in. Starting early will give businesses a head start and will make things easy.

Related Posts