Oil industry to encounter shakeout: A.T. Kearney

Manama : Cash-strapped oil sector will witness huge disruptions in the coming days, with many companies seeking the path of mergers and acquisitions apart from aggressive cost-cutting to fend off the financial crunch, according to A.T. Kearney’s Oil and Gas Merger & Acquisition (M&A) Outlook released recently.

Globally, firms with weak balance sheets will be forced to offload assets and seek partners to support their cash position as funding-options dry up, while companies in a stronger financial position will have the opportunity to capture reserve and merger synergies, it says.

Middle East oil companies, due to their low breakeven cost, are still profitable and can withstand the current crisis. They also have to focus on internal operational efficiency and economic diversification. More partnerships with international players can also be expected in Middle East, as per the report.

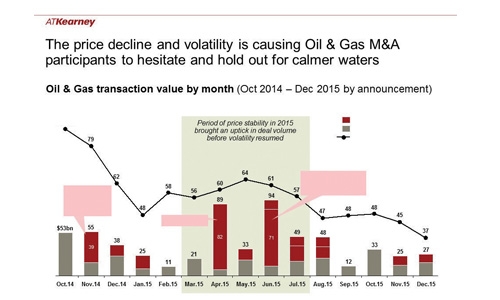

Globally, price volatility has created sharp differences in valuation expectations between buyers and sellers, delaying M&A decisions.

This year will be pivotal as cash and liquidity concerns drive a shakeout for those with high costs and debt, the report said. Operators with high debt holdings, especially those relying on reserve-based lending, could see their funding squeezed and credit facilities reduced, triggering them to shed low-performing assets.

Such a scenario will present opportunities for those willing and able to adopt contrarian strategies and take advantage of creative deal structures. M&A deals, whether acquiring, partnering, or divesting, will be vital to grow value, cut costs, and navigate the new, more turbulent landscape, said the report.

Stronger players will have the opportunity to acquire assets at a deep discount as debt covenants and redeterminations will play a larger role in triggering M&A. Financial investors will also seek opportunities to put capital to work, targeting different levels of return through varied M&A approaches.

Fiscal austerity in the Middle East will limit M&A activity in the region, but joint ventures and downstream investments looks promising, the report says. It also notes that except Middle East, oil-rig counts are falling across globe along with slashing of new investments.

Related Posts