‘Int’l banks should ease restrictions’

Manama : International banks, which have stopped or slowed down their correspondent banking services in the region should reconsider their decision, according to a recent study by the consulting group PWC.

Governor of Central Bank of Bahrain, in an international conference here, last month had urged international banks not to cut down their correspondent dealings in the region. He had said that Bahrain is in compliance with all international rules and conventions and it is being punished despite being a good citizen.

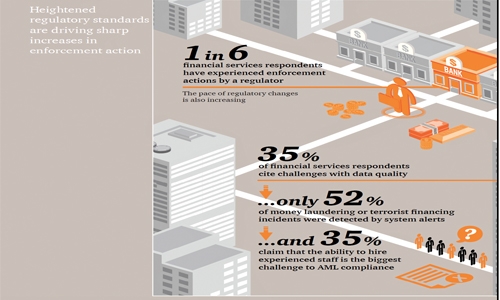

The Global Economic Crime Survey 2016 Middle East report by PWC, titled “Adjusting the Lens on Economic Crime in the Arab World,” while discussing the efforts by the organizations in the region to keep pace with increased regulations, said “the US, in particular, is driving the AML/CFT (anti-money laundering / counter-terrorist financing) agenda across the world, and Middle Eastern companies will not be immune.”

“For example, we have seen so-called ‘de-risking’, where US correspondent banks have ceased dealing with the banks in the region that they believe isn’t complying with regulatory requirements. This has major implications for those banks’ ability to offer services to local customers,” it said.

The study also observes, “the Middle East region has special challenges here, with an unusually wide range of both international banks and local banks with a global presence. There is also a very high level of money service businesses and cash transactions, combined with global trading hubs and a geographical proximity to unstable or sanctioned locations.”

It also says it is surprising that regional institutions aren’t finding it harder than to keep pace with regulations, though the challenges associated with complying to multiple jurisdictions are taken care of. PWC says that the region appears to be ahead of the curve in many areas of AML/CFT, and have hired 68 pc additional resources in the last two years.

The survey discussed in depth about in global economic crime in the Middle East since 2011. It says despite efforts to combat economic crime, there has been no clear indications that levels in the Middle East or globally have decreased.

According to the PwC Middle East Economic CrimeSurvey for 2016, 26 pc of organisations in the region have experienced economic crimes in the past 24 months, lower than the global average of 36pc.

Although the number of affected organisations in the Middle East was lower compared to the global average, the number of organisations unaware of the fact that they were victimied in the region was much higher than the global average (20 pc against 11 pc), indicating uncertainty as to whether their organisations are experiencing economic crime.

Related Posts