JIB posts profits before tax of US$105.4 million

Jordan Islamic Bank (JIB) announced yesterday that it has achieved profits before tax in an amount of US$105.4 million by the end of 2015, compared with US$90.1m in the previous year; with a growth of nearly 17 per cent Net profits after tax reached US$68.7m compared to US$63.6m in 2014; with a growth of 8pc.

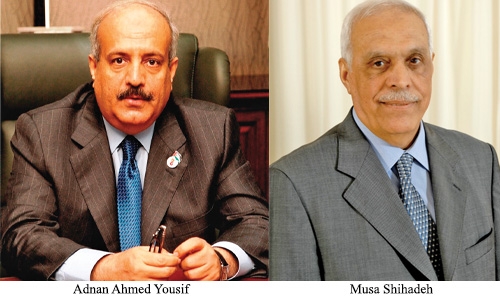

Adnan Ahmed Yousif, Chairman of JIB, President & Chief Executive of Al Baraka Banking Group (ABG)/ Bahrain expressed how much comfortable he is with the results the bank achieved in 2015 and also emphasized the bank’s interest in the continuation to expand its network of branches.

The board has also decided to recommend a dividend distributions to shareholders for the year 2015 by 15pc of the nominal value of shares.

Musa Shihadeh, CEO – General Manager of JIB said growth in total assets including (restricted investment accounts, Muqarada bonds and investment by proxy) reached around 8.2pc amounting to about US$5.88 billion compared to about US$5.44bn at the end of 2014 with an increase of about US$444m.

The growth in facilities granted for customers including (restricted investment accounts, Muqarada bonds and investment by proxy) reached around 20pc amounting to about US$4.44bn.

Shihadeh indicated that the growth in clients’ deposits (including restricted investment accounts, Muqarada bonds and investment by proxy accounts) reached around 8pc amounting to about US$5.29bn, compared to US$4.89bn at the end of 2014 with an increase of about US$389.28m.

Shareholders’ equity reached about US$438.64m compared to about US$397.74m at end of 2014 with a growth of 10.3pc. The return on average equity (ROAE) after tax reached about 16.42pc.

These results positively reflected on the performance indicators of the bank; Capital Adequacy Ratio (CAR) reached 21.11pc at end of 2015, return on assets average (ROAA) reached 1.33pc, the efficiency ratio reached 39.15pc, the non- performing finance(NPF) reached 3.87pc and their coverage ratio 106.9

Related Posts