Islamic finance didn’t need ESG The world is finally catching up

TDT | Manama

Email: mail@newsofbahrain.com

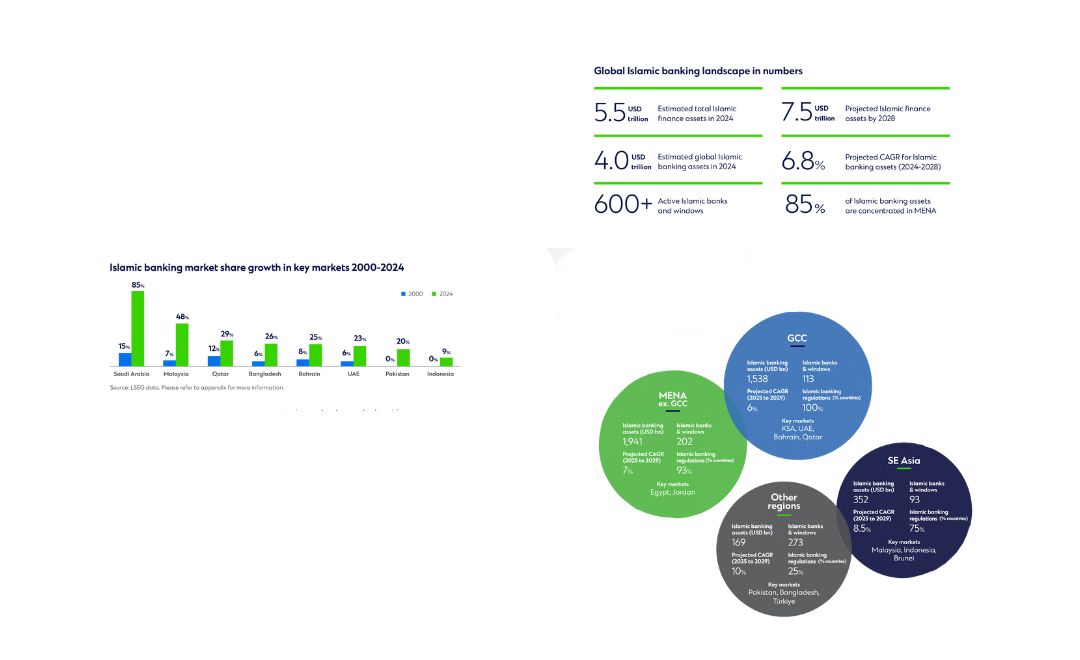

Islamic banking was never built on speculation detached from real assets. It was built on a code that filters harmful sectors, bans exploitation and forces fairness through transparency and risk sharing. Now, as global markets scramble to meet the rising expectations of environmental, social and governance (ESG) standards, a framework used by investors to assess sustainability and ethical behaviour, leaders inside the Islamic finance industry argue that the sector has long been operating along the same lines - without branding itself ESG.

Ethical Roots

In an interview with The Daily Tribune, Mohammad Ali Allawala, Head of Islamic Banking-UAE and Head of Islamic Wealth and Retail Banking - Group Islamic Banking at Standard Chartered, pointed out that Islamic finance and ESG principles are inherently complementary. He explained that Shariah screening, the ethical filters used in Islamic finance, excludes activities deemed unethical or harmful under Islamic principles, aligning closely with ESG’s negative screening by filtering out investments in sectors such as alcohol, ammunition, gambling, and fossil fuels. Mr. Allawala said that this alignment ensures that financing upholds both ethical integrity and environmental responsibility, adding that while many investors choose Islamic banking for religious reasons, many others are drawn to it because they view it as ethical financing.

Structural Ethics

The difference, Mr. Allawala argued, goes deeper than sector exclusion. Shariah-compliant financing is linked to real economic activity and avoids speculative structures that make money from money alone, which reinforces fairness in financial contracts through transparency, ethical conduct and risk-sharing. Islamic finance prohibits exploitative terms and mandates clear disclosure, ensuring all parties have equitable access to information and outcomes. In other words, where conventional markets often retrofit morality into investment products - adding ethical labels after the financial structure is built - Islamic finance embeds ethics at the structural level.

Sukuk Momentum

That foundation is now reshaping investor behaviour in the debt space. Mr. Allawala pointed to the broader investor appeal of ESG-labelled investments, noting that it is fuelling stronger demand for sustainable Sukuk and giving corporates greater leverage to secure more favourable pricing on debt. Sukuk are Shariah-compliant debt instruments similar to bonds, but backed by real assets rather than interest-based lending. According to LSEG research, sustainable Sukuk were subscribed at an average of 4.3 times their issuance value, compared to 3.1 times for traditional Sukuk in 2024, meaning investors demanded far more than what was offered. He said this additional demand has been largely driven by global investors who historically did not invest in Sukuk and is described in the bank’s most recent report, ‘Islamic Banking for Corporates: Broadening Horizons’.

Fintech Catalyst

Technology is accelerating the change. For years, the reach of Islamic finance was constrained by physical branches, manual onboarding and advisory processes that were slow and difficult to access. Mr. Allawala said this dynamic is being overturned by fintech. Digital onboarding and mobile-first banking are making Shariah-compliant products more accessible and efficient, especially for younger consumers and underserved markets where infrastructure remains thin. He noted that fintech can significantly expand the reach of Islamic finance by lowering operational costs, opening wider distribution channels and enabling people in different countries to access Islamic financial services.

Innovation Friction

The shift is not frictionless. Mr. Allawala highlighted the challenges that come with rapid innovation. He said that Shariah scholars and fintech developers need closer collaboration so that new digital products remain compliant without blocking creativity. As services move online, cybersecurity, data privacy and consumer trust become even more important. He added that opinions on digital assets such as crypto still differ among regulators and Shariah authorities, and that gaps in digital awareness in some regions continue to limit adoption, although he noted that the gap is closing quickly.

Liquidity Barrier

Liquidity remains the industry’s great test. Sukuk demand exceeds supply, but Islamic markets still face barriers that prevent them from reaching the liquidity of conventional bonds. Mr. Allawala said that the key enablers are standardising structures and documentation, encouraging more active trading, attracting a wider base of global investors, and more regular, large-scale issuances from sovereigns and top-tier corporates to create reference Sukuk for the market. He said technology will also play a major role, with tokenisation and digital platforms making Sukuk more accessible, transparent and easier to trade.

Global Framework

As Islamic finance expands beyond its traditional heartlands such as the Middle East and Malaysia, the rulebook will need to evolve. Mr. Allawala said that the regulatory framework will move toward greater standardisation and closer coordination between Islamic standard-setters and mainstream regulators. He noted that bodies such as the Accounting and Auditing Organization for Islamic Financial Institutions, which issues standards for Islamic finance, and the Islamic Financial Services Board, which provides supervisory guidance, will remain central. He added that cooperation among industry practitioners, regulators, Shariah authorities and standard-setting bodies is already increasing. Mr. Allawala said that the key enabler for this evolution is the mindset to make Islamic finance more inclusive and easier for clients to adopt across different markets.

Wealth Products

Against this backdrop, Standard Chartered has begun introducing Sharia-compliant wealth solutions designed to meet rising demand. Mr. Allawala said it has been an exciting time as the bank has launched the Signature Chief Investment Office Islamic Funds, a new range of Shariah-compliant investment solutions. The initial launch in Bahrain features two funds, the Signature CIO Islamic Growth Fund and the Signature CIO Islamic Income Fund, with plans to expand the range. He explained that clients who invest in the funds can access four key asset classes - Global Islamic Equity, Global Sukuk, Gold and Cash - and benefit from the combined expertise of Standard Chartered’s Chief Investment Office for asset allocation, Lazard Asset Management for Global Islamic Equity and Aditum for the Global Sukuk portfolio. He added that investors enjoy the peace of mind of ethical investment as the funds do not invest in industries detrimental to society, such as arms and ammunition, tobacco and alcohol. Clients have a choice of two fund types based on their investment objectives, with monthly dividend distribution in the Income Fund.

GCC Acceleration

In the Gulf, fintech is no longer a supporting player - it is becoming a structural accelerant. Mr. Allawala noted that fintech in the Islamic finance space in the GCC has grown rapidly and is supported by regulatory sandboxes, which allow new financial services to be tested under controlled supervision, and systems that ensure products meet Islamic finance principles. He said that in Bahrain, clients can already use Standard Chartered’s mobile banking platform for Saadiq Islamic banking, showing how digital services are moving from pilot phases to everyday use.

Recognition Test

For a global financial industry wrestling with the politics of ESG, Islamic finance does not need to reinvent itself. Its rules of exclusion, transparency, risk-sharing and ethical conduct were written long before the world started branding such filters as sustainability. The question now, Mr. Allawala suggests, is whether markets will recognise that what ESG promises, Islamic finance has already been doing - and whether investors are ready to support these models in ways that scale access, deepen liquidity and sustain long-term market confidence.

sdfds

Related Posts