Stocks Sink on Trump Tariffs, US Jobs Data

AFP | London, United Kingdom

Email : editor@newsofbahrain.com

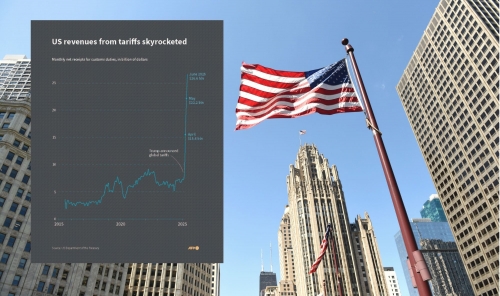

Stock markets tumbled on Friday following US President Donald Trump’s announcement of tariffs targeting dozens of trading partners, compounded by weaker-than-expected US jobs data.

Wall Street’s Dow Jones index fell more than 1.2% as trading opened in New York, while European markets also slid sharply—Paris’s CAC 40 dropped over 2.8%, and Frankfurt’s DAX fell 2.6%. The US dollar lost earlier gains against major currencies.

With only hours left before the August 1 deadline for governments to negotiate deals to avoid tariffs, Trump unveiled a sweeping list of new levies. Shortly thereafter, the US Labor Department reported the economy added just 73,000 jobs in July, revising down previous figures for May and June.

“The US payrolls data has eclipsed news about the latest tariff rates applied to the world’s economies by Donald Trump, and is now dominating markets,” said Kathleen Brooks, Research Director at XTB trading group.

Where Will Trump’s Tariffs Hit Hardest?

Trump’s administration declared tariffs ranging mostly between 10% and 35% on roughly 70 economies, including a severe 35% levy on Canada. Key trading partners such as Britain, the European Union, Japan, and South Korea have negotiated deals to avoid or reduce the impact, while China remains in fragile talks to extend a truce initiated in May.

Tariffs affect major regions as follows:

-

Europe: Up to 35% on the EU, 18-20% on Britain and Switzerland

-

North America: 35% on Canada, 15% on Mexico

-

Asia: Varied rates from 10% to 25-30% on China, Japan, Vietnam, India, and others

-

Other regions: Tariffs also target Brazil, Chile, Colombia, Israel, South Africa, and others, with rates varying by sector.

Market Highlights at 1345 GMT:

-

Dow Jones: ▼ 1.2% at 34,591.47 points

-

S&P 500: ▼ 1.4% at 6,253.54

-

Nasdaq: ▼ 1.8% at 20,745.60

-

FTSE 100: ▼ 0.9% at 9,055.06

-

CAC 40: ▼ 2.8% at 7,554.36

-

DAX: ▼ 2.6% at 23,453.00

-

Nikkei 225 (close): ▼ 0.7% at 40,799.60

-

Hang Seng Index (close): ▼ 1.1% at 24,507.81

-

Shanghai Composite (close): ▼ 0.4% at 3,559.95

Currency movements included a rise in the euro against the dollar to $1.1570 and the pound to $1.3273, while the dollar weakened against the yen to 148.23 yen. Oil prices fell slightly, with West Texas Intermediate at $68.91 per barrel and Brent crude at $71.25.

Brooks noted tariffs have been “the main theme sucking risk sentiment from financial markets.” Governments worldwide have scrambled to negotiate with the White House since Trump first announced the tariffs, known as “Liberation Day” tariffs, initially set for July 31 but delayed to August 7.

Despite ongoing negotiations, the tariffs underscore Trump’s aggressive approach to reshaping global trade in favor of the US economy, sparking uncertainty and volatility in financial markets.

Related Posts