Beyon Q4, FY23 profits rise

TDT | Manama

The Daily Tribune – www.newsofbahrain.com

Boosted by expansions in mobile, wholesale, and digital services, Bahrain Telecommunications Company (BEYON) posted a surge in profits for both the fourth quarter and the entire fiscal year of 2023 compared to the previous year.

During this period, overall customer base grew by 2% YoY with increases in mobile customers of 11% in Batelco Bahrain, 5% in Umniah in Jordan and 3% in Sure Group.

Based on this, the Board of Directors recommended a full year cash dividend of BD64.7 Million (US$171.6M), at a value of 39.0 fils per share which includes the regular dividend of 32.5 fils per share plus an additional special dividend of 6.5 fils per share.

The 2023 interim dividend of 13.5 fils per share was already paid during the third quarter of 2023 with the remaining 25.5 fils to be paid following the AGM in March 2024.

Fourth quarter

Fourth quarter net profit attributable to equity holders of the company was BD16.5M (US$43.8M), a 2% increase from BD16.2M (US$43.0M in the year-earlier quarter. Earnings per share (EPS) are 10.0 fils compared to 9.8 fils in Q4 2022.

Total comprehensive income attributable to equity holders was BD24.8M (US$65.8M), a 12% increase from BD22.1M (US$58.6M) in the prior-year quarter, mainly due to investment fair value changes.

Operating profit increased 2% to BD24.4M (US$64.7M) from BD24.0M (US$63.7M) in Q4 2022.

Revenues increased 5% to BD109.5M (US$290.5M) from BD104.6M (US$277.5M) in Q4 2022.

Full year

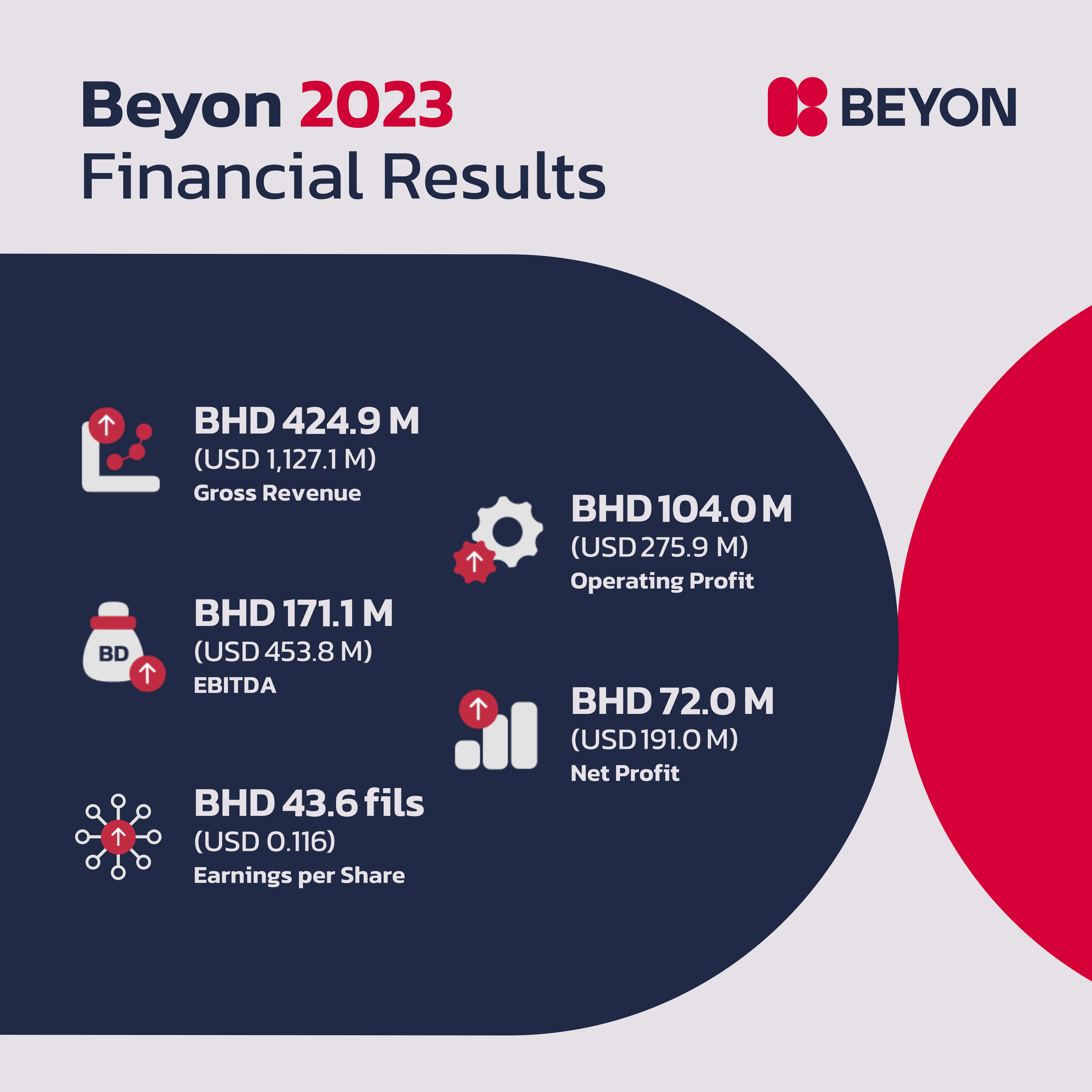

Full year 2023 net profit attributable to equity holders of the company was BD72.0M (US$191.0M), up 2% from BD70.3M (US$186.5M) in 2022.

Earnings per share (EPS) are 43.6 fils compared to an EPS of 42.5 a year ago.

Total comprehensive income attributable to equity holders of the company is up by 57% from BD58.2M (US$154.4M) in 2022 to BD91.6M (US$243.0M) in 2023 resulting from foreign exchange translation differences and investment fair value changes.

Operating profits increased by 11% from BD93.6M (US$248.3M) in 2022 to B D 1 0 4 . 0 M (US$275.9M) in 2023.

Similarly, EBITDA increased by 3% from BD165.4M (US$438.7M) in 2022 to BD171.1M (US$453.8M) in 2023.

The company maintained a healthy EBITDA margin of 40% in 2023. Revenues was BD424.9M (US$1,127.1M), increased by 5% from BD402.8M (US$1,068.4M) in 2022, mainly due to increases in mobile, wholesale and digital services.

Beyon Chairman Shaikh Abdulla bin Khalifa Al Khalifa said, “Beyon has an ambitious strategy to grow outside of Bahrain through strategic acquisitions and partnerships and by taking our digital brands into new regional and international markets.

The Board of Directors is proud of the good progress achieved which includes acquisitions by Beyon Cyber and Beyon Solutions, while Beyon Connect established a joint venture in partnership with Egypt Post, and Beyon Money entered the UAE market.”

Beyon CEO Mikkel Vinter said, “We are pleased with the progress made during 2023 with many notable achievements, taking us closer to our vision of being a technology powerhouse.”

Related Posts