Boosting digital transformation

Manama : The Central Bank of Bahrain (CBB) is determined to promote the digital transformation of Bahrain’s financial sector ‘quickly and efficiently’.

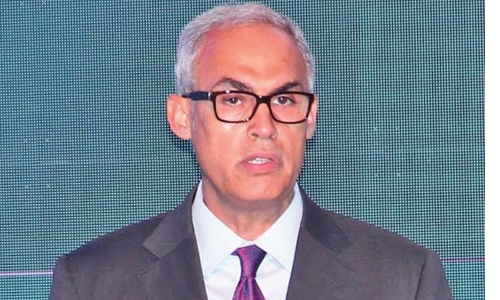

Rasheed Al Maraj, the Governor of the Central Bank of Bahrain, said this while speaking at a one-day workshop on ‘Digital Transformation’ at the CBB headquarters.

While explaining the need to have the right mix of regulations to implement new technologies, he, however, said that the challenge is to develop the digital financial products in a risk-free way.

Al Maraj said that, by the end of next month, CBB will issue draft rules for consultation on crowd funding platforms for both conventional and sharia’a compliant services.

“CBB managed over the past two years to introduce new products for the Retail Banking sector, making sure they do not restrain the implementation of new technologies in Bahrain by having the right mix of regulations,” he said.

The highlight of the seminar on ‘Digital Transformation’ was a presentation on the subject by BNB officials led by Jacques Michel, Head of Middle East & Africa on the subject.

“These seminars and workshops are crucial towards developing awareness and expertise in financial technology, and we appreciate BNP Paribas’ initiative to share with CBB their expertise in this growing and important field and CBB will continue to support and welcome these initiatives from the industry,” Al Maraj said.

Commenting Jacques Michel, Head of BNP Paribas said, “We strongly believe in sharing our internal expertise with our partners and as such, are delighted to have delivered today’s Digital Seminar at the Central Bank, hosted by, Rasheed Mohammed Al Maraj.”

Al Maraj added that the new initiatives are a continuation of the CBB’s efforts to provide the right mix of policies and products to enhance the quality and competitiveness of services provided.

In this regard, he also highlighted a white paper issued last week for consultation on a Regulatory Sandbox in Fintech which allows companies to test their Fintech solutions.

Related Posts