GCC businesses urged to develop better corporate governance

Corporate governance will be a key factor in the sustainability of businesses in the region, said a recent report by Crescent Enterprises.

“While significant progress has been achieved over the past decade in establishing governance frameworks for listed companies in particular, and especially in countries with large capital markets, progress in improving governance of privately-held family firms has been slower. As a result, the quality of governance practices displayed by privately-held firms in the Region varies significantly. While some have embraced a culture of better governance, others are persisting with practices that are dangerously ill-suited to the Region’s increasingly complex and globally-integrated economic environment,” the report said.

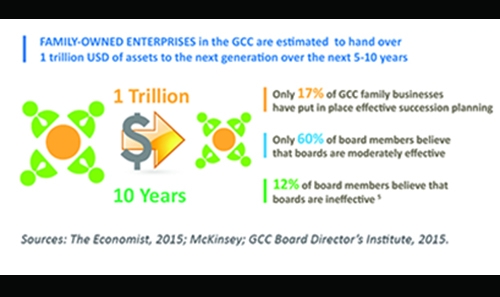

Family businesses are expected to have a generation shift in the next decade and majority of them are transitioning from the second to third generation. “This succession is where the greatest destruction of value has occurred in the past with, on average, only 30 pc of family businesses surviving beyond the third generation.”

The report said that stronger corporate governance policies could alleviate this risk, which has a potential to negatively impact the employment and economic activity in the region.

Even though, most families recognize the need for better corporate governance structure in place, implementing the same understanding has met with little success. The report calls for policy reforms to create an enabling environment for better governance in the region.

“Events witnessed in the Middle East and North Africa over the past five years have resulted in a profound questioning of the economic and social model in several countries of the Region.

The old formula, whereby governments act as the primary providers of essential goods/services and employment, is being tested by recent political and macroeconomic developments. Notably, the falling price of oil and the resultant reduction in export revenues have resulted in reduced fiscal capacity for oil-exporting countries, while the economic performance of many oil-importing countries continues to be affected by conflict and instability,” said the report written in partnership with the Pearl Initiative.

The report notes that the region’s firms are often concentrated in sectors characterised by low levels of innovation and intangible capital, high dependency on natural resource inputs, and formidable barriers to entry.

This situation stands in contrast with the world’s largest and most successful firms that are often characterised by high intangibles, ability to scale globally and a “networked” business model. It perpetuates the lack of competition in a number of key sectors, a characteristic that has a number of negative repercussions, including lower economic productivity, innovation and foreign investment. Finally, it affects both the short-term competitiveness and the long-term prospects of MENA-based firms for integration in global value chains, which have emerged as a key source of economic growth, the report points out.

Badr Jafar, CEO, Crescent Enterprises, founder of the Pearl Initiative, and a member of the WEF”s MENA Regional Business Council, commented: “There has never been a stronger business case for embracing the principles of good corporate governance. A community of well-governed businesses create stable economies and in-turn stable societies, which are what businesses need to thrive. As the saying goes, ‘what goes around comes around’, and if we want to see strong opportunities generated for the millions of young men and women across the Region then we need to take responsibility for the sustainability and health of the companies we are growing here.”

Related Posts