‘Bahrain committed to ensure ideal business climate’

Manama : Bahrain is committed to continuing regulatory improvements to streamline the innovation process and ensure the business climate is ideal for investment, said Khalid Al Rumaihi, Chief Executive of the Bahrain EDB.

Citing reforms including the introduction of regulatory sandbox as well crowdfunding regulations to enable greater access to new sources of capital, Al Rumaihi pointed out that Bahrain’s long history as a leader in Islamic finance, paired with a strong track record in creating the right environment for businesses to adapt quickly to new technologies, means that “we are fast becoming a key driver of growth in the Islamic fintech industry.”

“Bahrain FinTech Bay, MENA’s largest FinTech hub, launched last month and we are looking forward to seeing different players in the sector come together to create truly innovative fintech and Islamic fintech solutions,” he added.

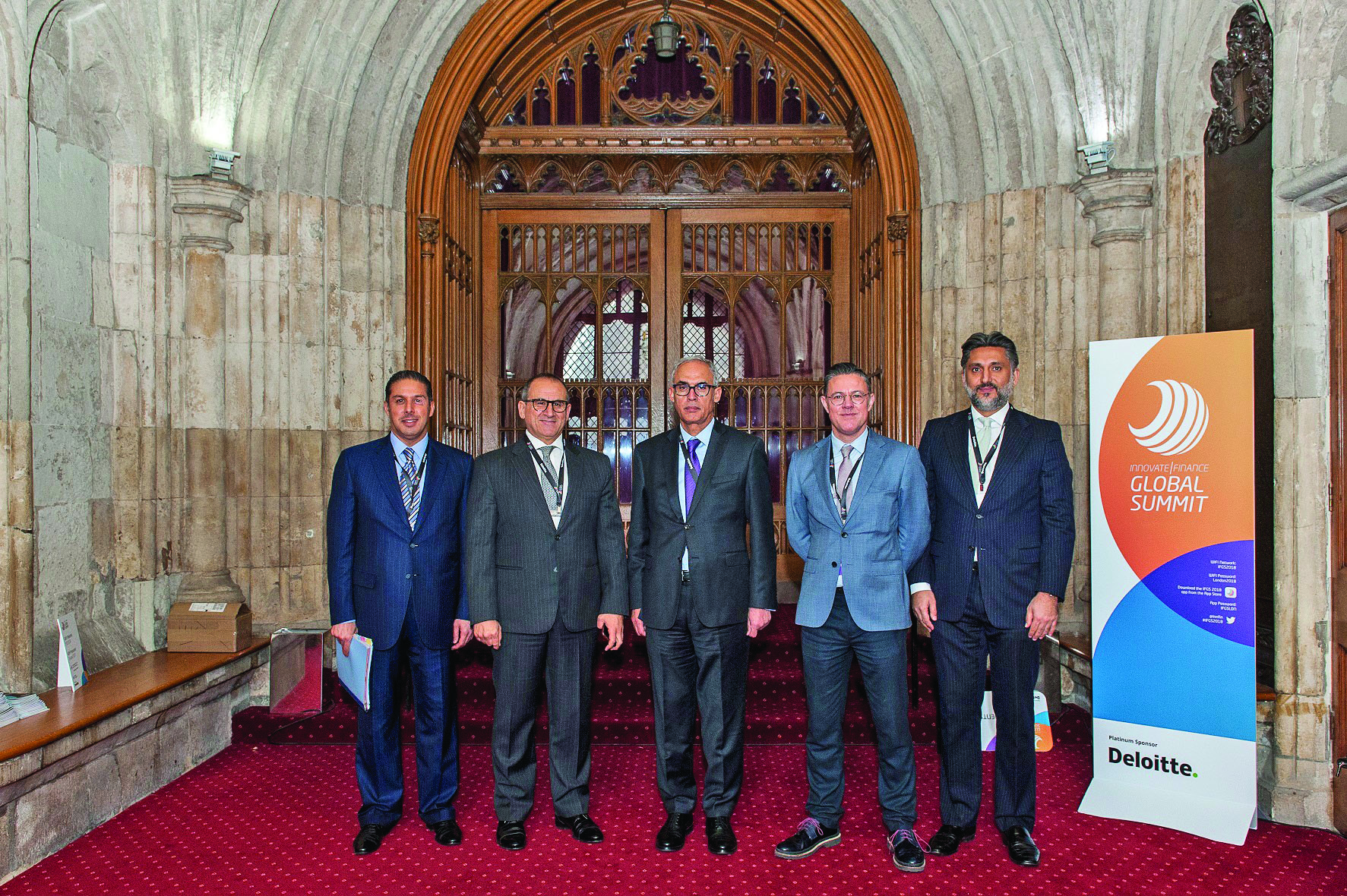

Al Rumaihi was speaking during a summit held as part of the Innovate Finance Global Summit held in London from 19-20 March as part of Bahraini delegation to showcase investment opportunities in Bahrain’s financial services sector. The roundtable discussion focused on the importance of building global collaboration between Islamic fintech hubs.

The summit brought together the world’s leading financial institutions, investors, policymakers, regulators, and international trade bodies to discuss the impact of fintech as a driver of disruption and innovation.

The delegation from Bahrain included Rasheed Al Maraj, Governor of the Central Bank of Bahrain (CBB), Zayed bin Rashid Alzayani, Minister of Industry, Commerce and Tourism, Khalid Al Rumaihi, Chief Executive of EDB, as well as senior representatives from the private sector.

Rasheed Al Maraj delivered a keynote address during the summit and took part in a panel discussion where he highlighted Bahrain’s recent fintech developments, including the region’s first onshore regulatory sandbox.

Zayed bin Rashid Alzayani said: “With over four decades as a regional financial centre led by our dynamic Central Bank, Bahrain provides many opportunities in FinTech, payments, Islamic finance and wealth management.”

While in the United Kingdom, the EDB also hosted a workshop on Bahrain’s recently streamlined procedures for trust registration, developed to enhance the competitiveness of its Trusts Law and to reinforce the Kingdom’s position as a regional powerhouse in the financial services industry.

Bahrain is the only country in MENA region with onshore and nationwide trusts law, first introduced more than ten years ago in 2006. The Kingdom’s world-class regulation for trusts includes the recognition of foreign trusts, 100% foreign ownership of trust property, provisions for trusts to be governed by foreign laws, the setup of unilateral trusts, and globally leading standards of protection for beneficiaries, supervised by the Central Bank of Bahrain.

Related Posts